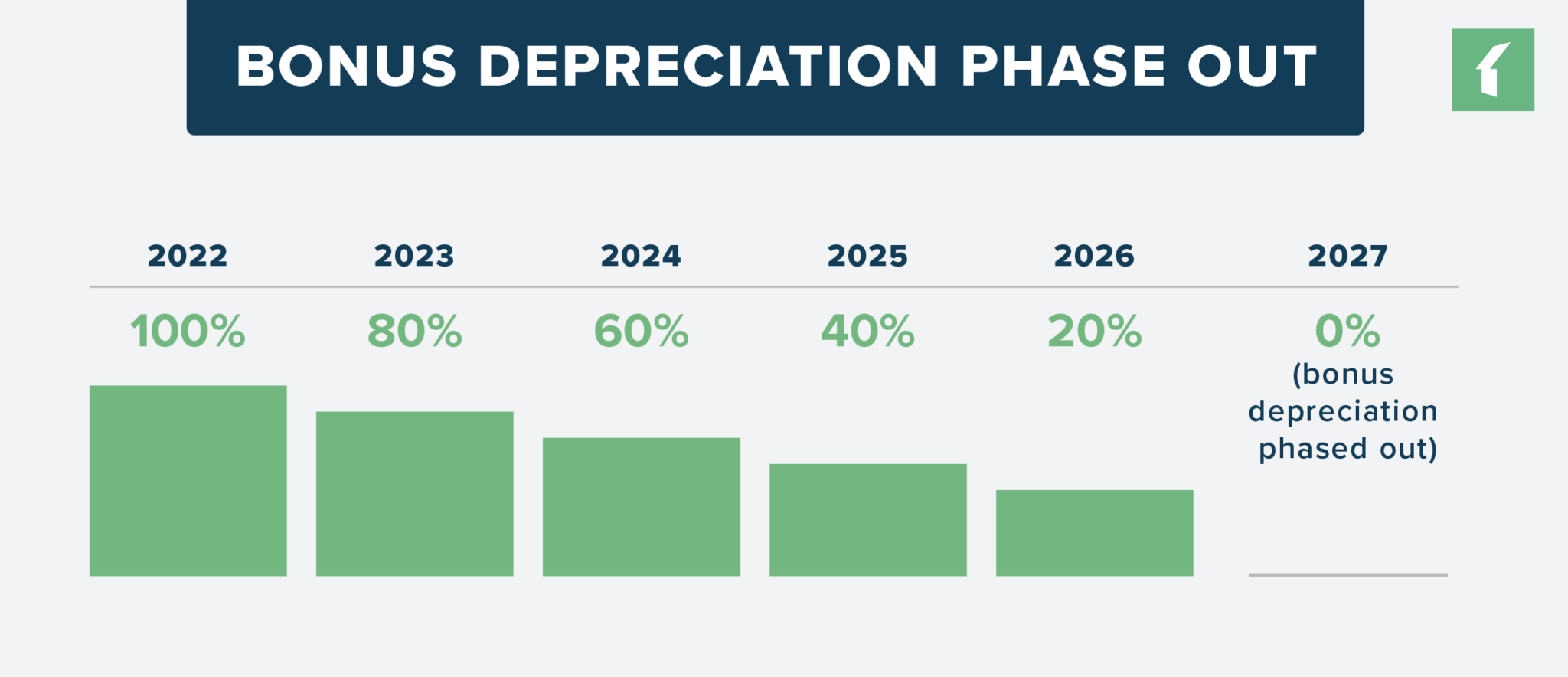

2025 Bonus Depreciation Percentage Chart

2025 Bonus Depreciation Percentage Chart. 31, 2022, and before jan. Tax cuts and jobs act.

In the recently held first quarter earnings conference call, c3i, a maritime shipping company, reported a significant increase in its financial performance for q1. One of the allowable deductions under the income tax act is.

Prior To Enactment Of The Tcja, The Additional First.

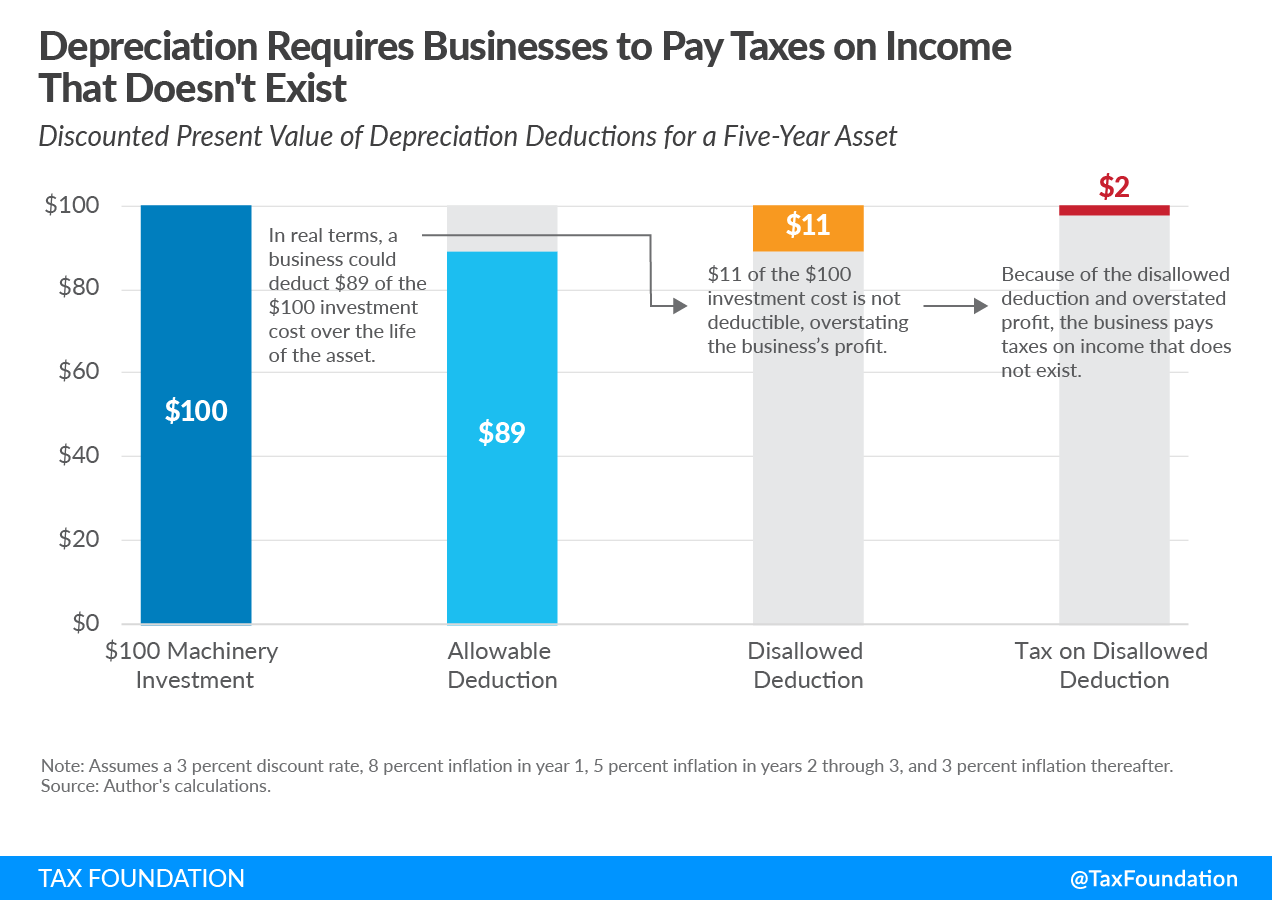

One of the allowable deductions under the income tax act is.

Iit Kanpur Graduate, Now Upsc 2023 Topper New Rummy App.

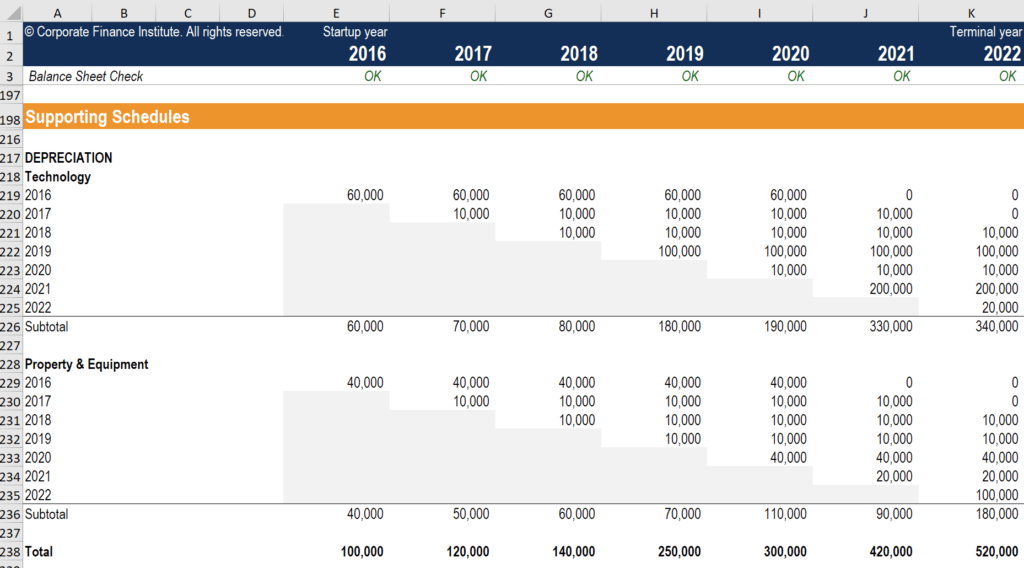

We also include the macrs depreciation.

Our Free Macrs Depreciation Calculator Will Provide Your Deduction For Each Year Of The Asset’s Life.

Images References :

Source: sailsojourn.com

Source: sailsojourn.com

8 ways to calculate depreciation in Excel (2025), 20% this schedule shows the percentage of bonus depreciation that businesses can claim for eligible assets in each year. Bonus depreciation works by first purchasing qualified business property and then putting that.

Source: www.calt.iastate.edu

Source: www.calt.iastate.edu

Using Percentage Tables to Calculate Depreciation Center for, The tax relief for american families and workers act of 2025, h.r. 100% bonus depreciation, when placed in service between 9/28/2017 and.

Source: www.buildium.com

Source: www.buildium.com

Bonus Depreciation Saves Property Managers Money Buildium, In 2025, it’s scheduled to drop to 60% (40% in 2025, 20% in 2026 and 0% in 2027 and beyond). The full house passed late wednesday by a 357 to 70 vote h.r.

Source: taxfoundation.org

Source: taxfoundation.org

Bonus Depreciation Effects Details & Analysis Tax Foundation, News april 09, 2025 at 04:14 pm share & print. The bill rolls back the requirement that began in.

Source: aeroliftusa.com

Source: aeroliftusa.com

Changes to Section 179 and Bonus Depreciation Aero Lift Inc., Prior to enactment of the tcja, the additional first. 7024, the tax relief for american families and workers act of 2025, which.

Source: jobs.marsballoon.com

Source: jobs.marsballoon.com

Depreciation Schedule Guide, Example of How to Create a Schedule, 0% how does bonus depreciation work? The deduction will be phased down over a period of several years as follows:

Source: www.hechtgroup.com

Source: www.hechtgroup.com

Hecht Group The Depreciation Deduction For Commercial Property, Tax cuts and jobs act. Qualified property eligible for bonus depreciation includes depreciable assets.

Source: www.matthews.com

Source: www.matthews.com

Bonus Depreciation Expiration, Phase down of special depreciation allowance. The special depreciation allowance is 80% for certain qualified property acquired after september 27, 2017, and placed in service.

Source: printable-templates1.goldenbellfitness.co.th

Source: printable-templates1.goldenbellfitness.co.th

Free Depreciation Schedule Template FREE PRINTABLE TEMPLATES, How does bonus depreciation differ from section 179. The special depreciation allowance is 80% for certain qualified property acquired after september 27, 2017, and placed in service.

Source: johnannaonghas.blogspot.com

Source: johnannaonghas.blogspot.com

Macrs depreciation calculator rental property JohnannAonghas, First, bonus depreciation is another name for the additional first year depreciation deduction provided by section 168 (k). Without this retroactive treatment, bonus depreciation would be 80% in 2023 and 60% in 2025.

Eligible Assets Include Depreciable Personal Property Such As.

Our free macrs depreciation calculator will provide your deduction for each year of the asset’s life.

31, 2022, And Before Jan.

The bonus depreciation rate started its descent, decreasing by 20% annually.