How To Adjust 401k Investments For 2024

How To Adjust 401k Investments For 2024. The best advice according to experts is to resolve to act now, even if your contributions are modest. Many workers set up or adjust their retirement plans as the new year begins, but.

Your contribution will be taken out of each paycheck before taxes and you can adjust the amount at any time. In 2024, employees under age 50 can contribute a maximum of $23,000 to their 401(k).

Annuities, Bonds, And Cds Can Provide Attractive Income As Interest Rates Rise.

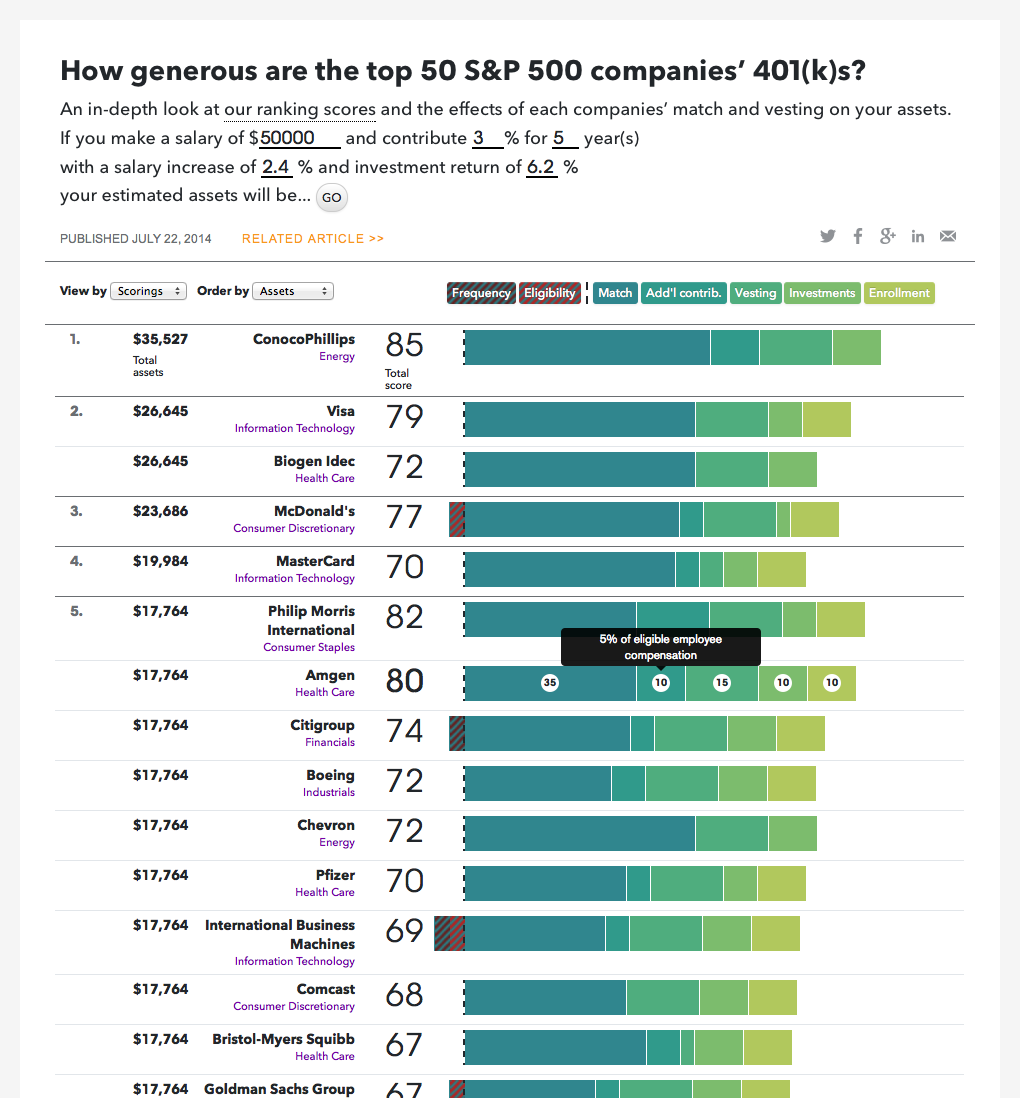

Maximizing your 401(k) involves understanding the investments offered, which are best suited for you, and how to manage them, among other strategies.

You May Opt To Put A Certain Percentage Of Your Money Into Relatively Aggressive.

This generation includes many retirement investors age 50 and over who become eligible.

Careful Planning Can Help You Navigate The Ups And Downs Of Markets And Help Position You Better For The Future.

Images References :

Source: marysawkassi.pages.dev

Source: marysawkassi.pages.dev

401k Contribution Limits 2024 Catch Up Over 50 Dacy Rosana, Maxing out your 401 (k) is often not the best move if you don't have unlimited funds for retirement savings. In 2024, employees and employers can contribute a combined maximum of $69,000 (or $76,500 if the employee is age 50 or older).

Source: www.youtube.com

Source: www.youtube.com

How to Change Your Fidelity 401k Investments YouTube, For investments in a retirement account, you have more than enough time for your stocks to regain any value they lose on paper in a bear market, as long as you don’t panic. The 2022 legislation had over 90 provisions in it that encourage more people to save for retirement and to help grow their retirement savings.

Source: www.pinterest.com

Source: www.pinterest.com

401(k) plans are employersponsored retirement plans where employees, Consider scaling back expenses, making strategic use of cash, and increasing dependable sources of income. Maxing out your 401 (k) is often not the best move if you don't have unlimited funds for retirement savings.

Source: newsd.in

Source: newsd.in

IRS 401K Limits 2024 How will the 401k plan change in 2024?, Learn the latest updates and changes to 401k retirement plans in 2024 for better financial planning. How you might need to adjust your retirement plan in 2024 here are some of the challenges that could lie ahead this year, plus some suggestions for how you might deal with them to help secure.

Source: investdale.com

Source: investdale.com

Simple 401k Benefits, Rules, and Opportunities Investdale, Maxing out your 401(k) can improve your retirement readiness significantly. The main reason for rebalancing is to control risk, not necessarily to improve returns.

Source: shaylawemmey.pages.dev

Source: shaylawemmey.pages.dev

2024 Roth 401k Limits Moira Lilllie, Your contribution will be taken out of each paycheck before taxes and you can adjust the amount at any time. Many workers set up or adjust their retirement plans as the new year begins, but.

Source: www.youtube.com

Source: www.youtube.com

401K Investing Basics 📈 401K Investing Strategies (Part 1) YouTube, Careful planning can help you navigate the ups and downs of markets and help position you better for the future. Our may 2024 analysis showed that the average rate for full coverage insurance from.

Source: www.youtube.com

Source: www.youtube.com

401k Option 2 Target Date Funds Investing in Retirement Account for, You may opt to put a certain percentage of your money into relatively aggressive. For investments in a retirement account, you have more than enough time for your stocks to regain any value they lose on paper in a bear market, as long as you don’t panic.

Source: www.youtube.com

Source: www.youtube.com

401K Investing (How Should I Invest In my 401K?) Real Example Of 401K, 401(k) contribution limits have risen in 2024. Maxing out your 401 (k) is often not the best move if you don't have unlimited funds for retirement savings.

Source: norinewpetra.pages.dev

Source: norinewpetra.pages.dev

Best 401k Investments For 2024 Dore Nancey, Careful planning can help you navigate the ups and downs of markets and help position you better for the future. The 401 (k) contribution limit increased to $23,000 for 2024.

In 2024, The 403(B) And 457(B) Contribution Limit Is $23,000 For Personal Contributions.

Gen x, current ages 44 to 59.

The Main Reason For Rebalancing Is To Control Risk, Not Necessarily To Improve Returns.

The secure act 2.0 is bringing numerous changes to your 401 (k) in 2024.